Small Business Growth Strategies for Companies with $10M+ Annual Revenue

Discover actionable small business growth strategies used by $10M+ companies to achieve sustainable success and scalability.

October 15, 2025

Congratulations! You’re in the slim minority of US businesses that have hit $10 million in annual gross revenue or more.

But now there are new challenges to overcome.

The small business growth strategies that got you to this point aren’t working anymore.

Advertising costs are going up, sales cycles are getting longer, and your unique advantage doesn’t feel so unique anymore. To compound the woes, new competitors are stealing market share.

This is a normal part of small business growth, but ignoring it is dangerous.

Research from Inc. and the Kauffman Foundation found that two-thirds of fast-growing companies eventually regress, stall, or fail.

The reasons for failure at this level are different from early-stage startups.

Companies that create sustainable growth at scale do three things:

- Validate their competitive position quarterly.

- Build operations that can handle three times the volume without breaking.

- Track the specific key performance indicators (KPIs) that determine brand value instead of vanity metrics.

In the rest of this post, we’ll explore small business growth strategies that will enable you to grow at your scale without destroying what you’ve built.

But first, let’s explore why your organization is at a critical juncture in its business journey.

Why you need to define a business growth strategy at the $10M threshold

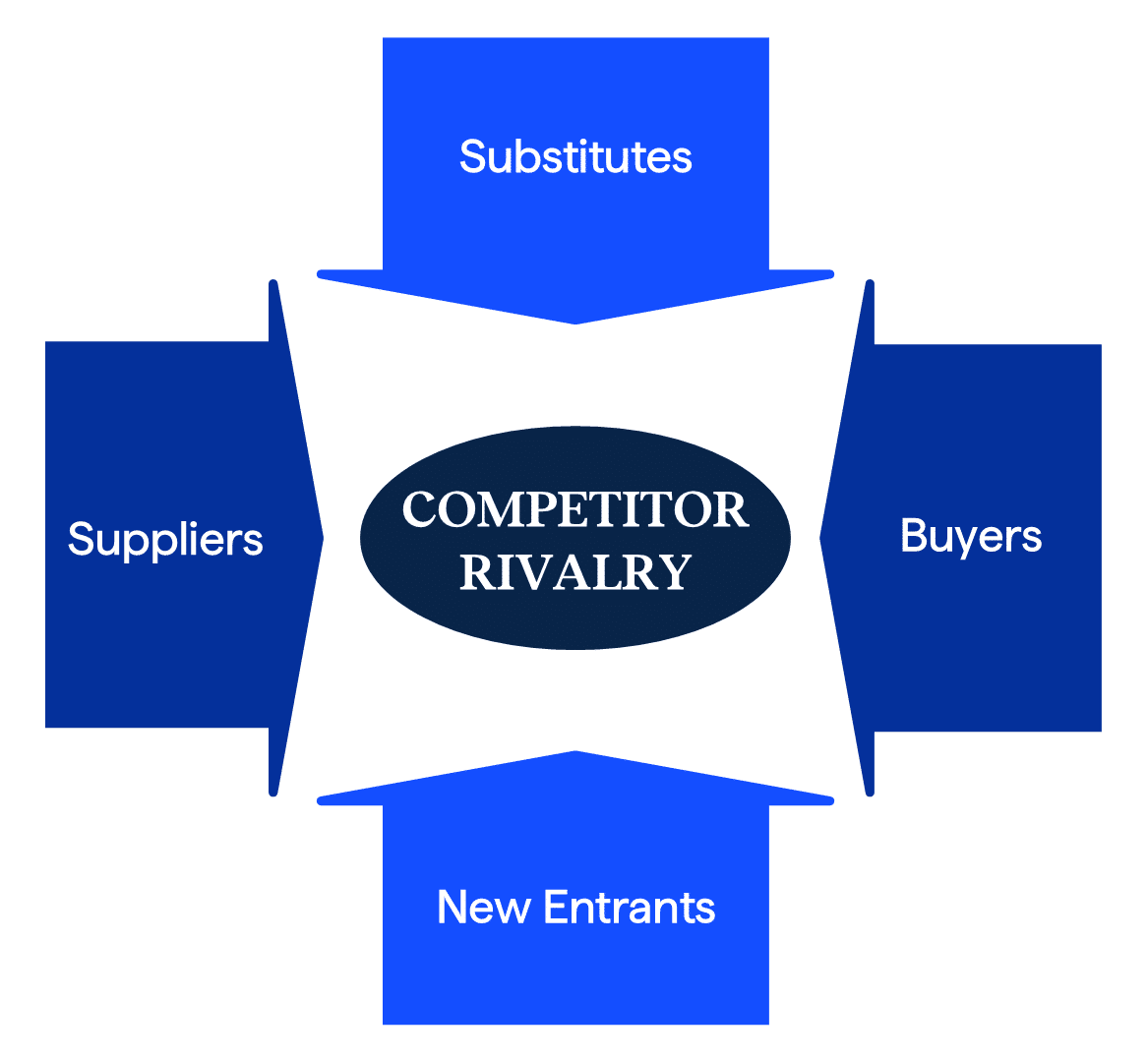

The $10M annual revenue mark represents a fundamental shift in how your business operates. Competitors see you as a serious threat because:

- You’re too big to be ignored but too small to have built defensive moats.

- Larger competitors target your customers with aggressive pricing or feature matching.

- Smaller competitors copy what you’ve done successfully.

Working capital needs increase exponentially with revenue. Customer acquisition costs rise as you exhaust early adopters and move to broader markets. Infrastructure investments become necessary-better systems, formal processes, professional management. What you could bootstrap before now requires intentional capital allocation.

These three shifts explain why two-thirds of fast-growing companies stall at this stage. When the business requires scale-stage strategy, the companies operate with early-stage tactics. The companies that break through recognize these changes early and adapt their approach deliberately.

How small business growth strategies at $10M+ differ from early-stage growth

The tactics that got you to $10M won’t get you to $50M.

Early-stage growth focuses on finding product-market fit, maximizing growth rate at any cost, building your initial customer base, and developing core offerings. You win through execution-working harder, moving faster, being more responsive than competitors.

At $10M+, the focus shifts completely. You’re defending market position against well-funded competitors, building operations that scale without breaking, managing margin pressure as acquisition costs rise, creating systematic competitive advantages that compound over time, and developing expansion revenue from existing customers.

The key difference is that early-stage companies can succeed through execution alone.

You need small business growth strategies that don’t depend on perfect execution every time. You win through better systems, clearer positioning, stronger processes, and more defensible moats-not just harder work.

Warning signs of impending growth challenges

Most growth problems reveal themselves through early indicators 6-12 months before they show up in revenue. If you catch them early, you have time to adapt. If you miss them, you’re managing a crisis.

Sales efficiency declines. Sales cycles lengthen by more than 20%. Customer acquisition costs rise faster than lifetime value. Win rates drop against both larger and smaller competitors. These patterns signal weakening differentiation or market positioning drift.

Operational stress occurs. Customer complaints about inconsistency increase. Employee turnover rises in key positions. “Emergency” fixes become routine. Quality issues appear in your core offerings. These indicate your processes can’t handle current volume, let alone growth.

Market position erosion occurs when competitors successfully copy your differentiation. Price pressure comes from multiple directions. Gross margins decline despite revenue growth. You lose “automatic” consideration in sales processes. Your competitive moat is filling in.

Team scaling issues arise. Key employees show burnout. You struggle to hire at previous salary bands. Coordination costs rise. Internal meetings multiply. Your organizational structure has outgrown your management capability.

These warning signs typically appear months before they damage revenue. If you’re seeing two or more of these patterns simultaneously, you’re operating with borrowed time. The strategies in this guide address each of these challenges systematically.

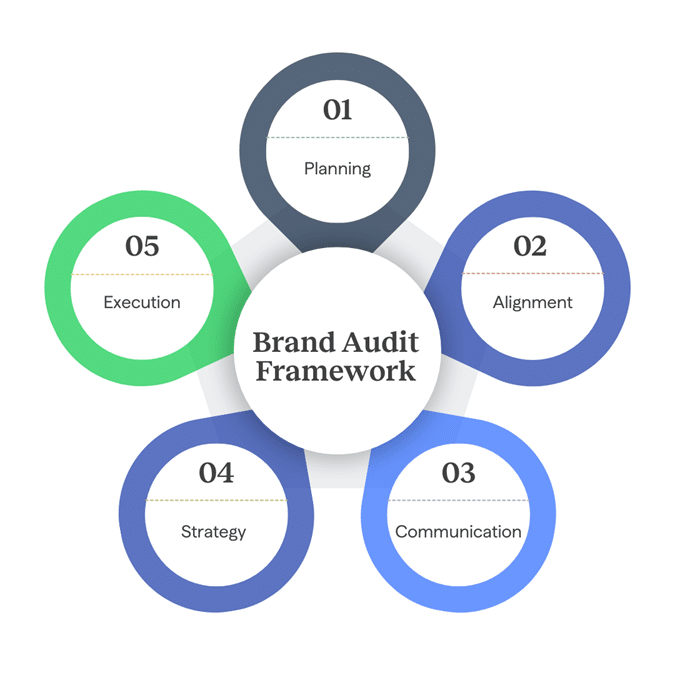

Start with a strategic brand audit

Businesses with annual revenues of $10 million or more must change the way they compete.

In the early stages, small businesses primarily compete on execution. You win customers because you’re faster, cheaper, or more attentive than alternatives. Outside of the company logo, your brand is what customers say about you after you deliver.

That’s fine when you’re building momentum. But at scale, competing on execution alone becomes unsustainable. You can’t out-hustle every competitor, nor can you be the cheapest without destroying margins.

You need something more defensible.

Competitors have taken notice. They’re watching you. They’re going after your customers and copying the things you do well.

At the same time, your business does not have systematic brand defenses in place. You’ve been focused on selling and delivering, and your brand has evolved organically, not strategically. That works until it’s time to push into a higher market. At that point, organic brand development becomes a liability.

This business transition happens gradually, then suddenly.

Here’s what I mean:

Sales cycles get longer because it takes more to convince buyers why you’re different. Close rates decline because your differentiation isn’t clear enough to justify prices. Marketing costs rise because you’re competing in increasingly commoditized channels.

By the time leadership recognizes these signs as symptoms of brand problems and not execution problems, you’re 12-18 months behind where you need to be.

This is why a strategic brand audit comes first.

Before you can achieve higher growth levels, you must know how your current brand is actually perceived in the market, how that perception has drifted from where you think it is, and what threats are eroding your market position before they show up in quarterly results.

The audit will help you uncover and correct brand drift.

Brand drift happens slowly enough that you don’t notice it in weekly pipeline reviews. Your brand is taking shape in the market whether you’re actively managing it or not. Competitors are positioning against you. Customers are forming perceptions. Analysts and reviewers are categorizing you.

The question is: Are you defining your brand strategically or letting market forces define it for you?

At your scale, you can no longer afford to let brand development happen organically or use guess work for competitive positioning.

You need an intentional brand strategy that creates distance between you and competitors, clarity for buyers about why you’re the right choice, and defensibility that protects your margins and market position.

Your brand is taking shape in the market whether or not you actively manage it.

Why an audit comes first in small business growth strategies

Most founders miss the connection to growth: brand clarity accelerates growth and brand confusion inhibits it.

When your brand strategy is clear and defensible, everything downstream gets easier and faster.

Sales cycles shorten because buyers understand why you’re different. Close rates improve because your differentiation justifies your pricing. Marketing efficiency increases because you’re not competing on the generic benefits everyone else is. Customer acquisition costs decline because strong brands generate referrals and inbound demand. Expansion revenue grows because customers who understand your unique value buy more over time.

The inverse is equally true. When your brand drifts or remains undefined, growth becomes expensive and fragile.

Most small businesses compensate for weak positioning with more sales activity, more marketing spend, more discounting, and more customer churn. Revenue might grow, but at declining margins and increasing capital requirements.

That’s not scalable growth-it’s an expensive treadmill.

Successful small business growth strategies begin with clarity about the company’s market position, what it stands for, and why it matters to specific buyers.

The brand audit establishes that clarity. Once you have it, every other growth lever-marketing, sales, operations, customer service-becomes more effective.

Now, the rest of this guide shows you how to activate those levers. They all rest on the foundation of knowing exactly where you stand in your market and where you need to go.

Brand clarity accelerates growth and brand confusion inhibits it. A brand audit provides clarity.

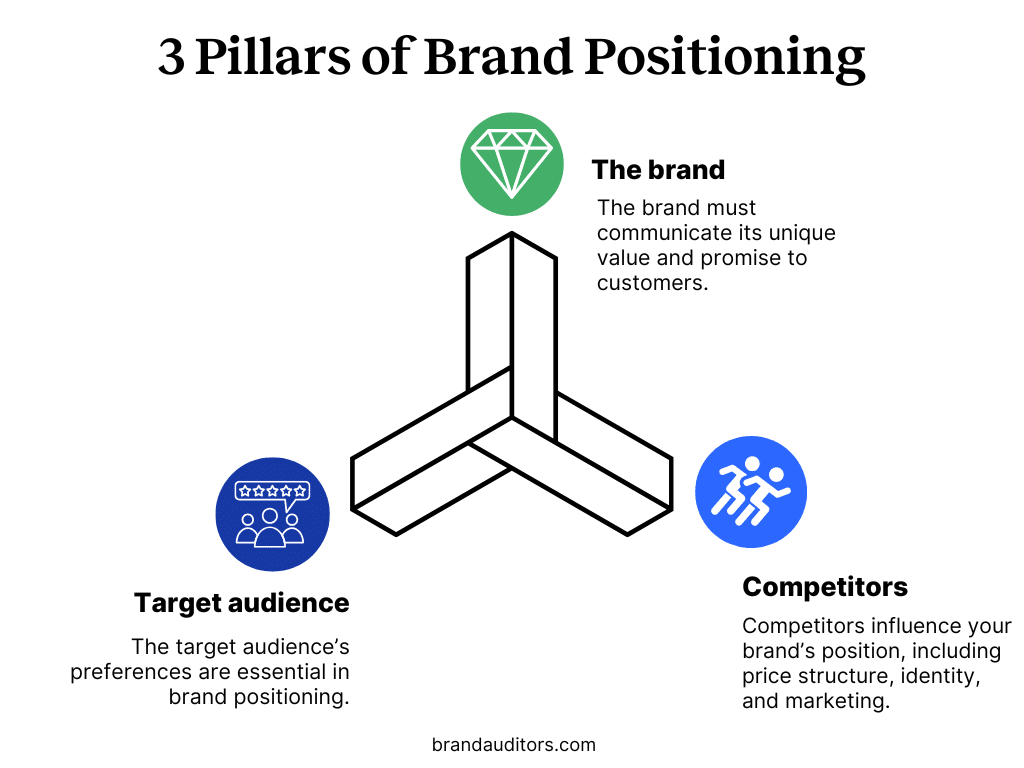

Defending your market position

You’ve already become successful in your market. Now you must defend your position against aggressive competitors and resist the temptation to put profit margins at risk by expanding horizontally.

Let’s start with marketing positioning. The niche market strategy could be the most reliable path to defending your position.

Business research shows that vertical specialists (niche specialists) command 23-40% price premiums over horizontal providers in business-to-business (B2B) markets. These premiums are driven by deeper domain expertise, custom workflows, and measurable business outcomes.

Buyers will pay more for proven expertise. They want vendors who speak their language, understand their regulations, and have solved their exact use case dozens of times.

The same is true for business-to-consumer (B2C) brands. Consumers are willing to pay more for niche products and services, especially when those offerings deliver specialized value, emotional resonance, or cultural relevance.

Generalists compete on features and price, while specialists compete on outcomes and trust.

You must continue to reinforce your competitive moat. Competitors study your successes and target your customers. Well-funded startups achieve feature parity faster than you expect. Lower-cost entrants force margin decisions. Adjacent market innovations raise customer expectations.

Generalists compete on features and price. Specialists compete on outcomes and trust.

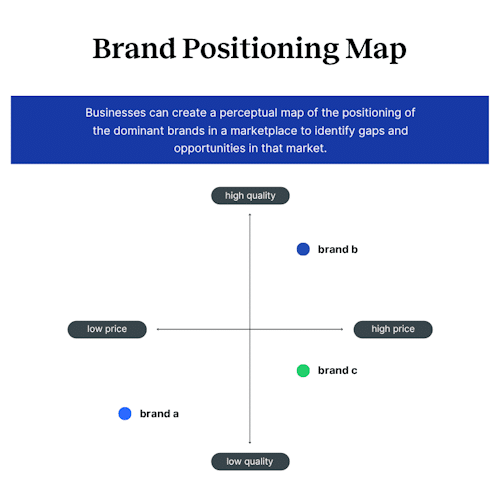

Analyzing competitors

You can’t compete unless you know what-and who-you’re competing against.

Surface-level competitive awareness isn’t enough. You need systematic analysis across six dimensions to reveal strategic patterns and opportunities:

Market positioning and messaging

How do competitors describe their value? What problems do they emphasize? What proof points do they use?

Study their website copy, case studies, and sales materials. Look for repeated language patterns-those reveal positioning strategy. Pay attention to what they don’t talk about. Omissions indicate weaknesses or missing capabilities.

If three competitors all emphasize speed and you emphasize accuracy, you’ve identified clear differentiation. If everyone claims the same benefits, you’re in a commoditized conversation.

Product and service comparison: What do competitors offer that you don’t, and vice versa? Where is feature parity assumed, and where does real differentiation exist?

In this step, you want to understand which capabilities matter to buyers and where you have defendable advantages.

Pricing strategy: How do competitors structure pricing? What’s included at each tier? How do they position value relative to price?

Pricing reveals strategic intent. Aggressive pricing indicates the company is attempting to capture market share rapidly. Premium pricing indicates differentiation claims. Frequent discounting reveals weak demand. Recent price increases show confidence and market power.

Go-to-market approach: Which channels do competitors use for acquisition? Where do they invest marketing dollars? What partnerships have they formed?

This reveals where the competitive battleground is most intense and where opportunities exist.

Customer perception: What do customers say about competitors in reviews, forums, and social media?

Carefully read negative reviews. They show what drives customers away and creates switching opportunities. Positive reviews help you understand what creates loyalty. Track review volume and sentiment trends over time.

Growth trajectory: Are competitors growing faster or slower than you? Have they raised capital recently?

Track their job postings. Engineering hiring indicates product development focus. Executive hiring signals scaling challenges or strategic shifts.

Document this in a simple matrix. For your top 3-5 competitors, list their core strength, primary vulnerability, and your competitive response strategy.

The goal isn’t to copy what competitors do. It’s to understand competitive dynamics well enough to make strategic decisions about where to invest, what to emphasize, and how to position.

Wait for market leadership before expanding

At the critical $10 million or more revenue level, there’s a strong temptation to expand because adjacent markets look easy to tap into.

However, horizontal moves mean you must spread capital, talent, and attention across multiple value propositions. Your competitive advantage weakens everywhere, including in your current market.

Here are four signs that you might be ready for expansion:

- Top 3 market share in your defined market: Dominating your niche is the sign of strong product-market fit, brand awareness, and operational maturity.

- More than 50% of inbound leads are from category-specific search and referrals. High-quality inbound signals brand clarity, organic demand, and reduced CAC.

- You’ve set pricing benchmarks instead of following competitors. Pricing leadership reflects differentiated value and brand authority.

- Competitors position against you, not the other way around. When competitors define themselves in relation to your brand, it signals category leadership and strategic influence.

This approach leverages:

- Customer economics that have been validated.

- Operational playbooks that scale.

- Brand equity that transfers across segments.

First, hit these markers. Then, expand by cloning your model into adjacent niches with similar customer economics and buying behavior.

Don’t start from scratch in a new market. Scale by pattern recognition, not experimentation.

Sources for the recommendations above:

- Bessemer Venture Partners – Scaling from $1M to $10M ARR

- Forbes Business Council – Tactics for Small Businesses

- Monetizely – Vertical SaaS Pricing Premiums

- Brett Trainor – Why 99 out of 100 Businesses Never Reach $10M

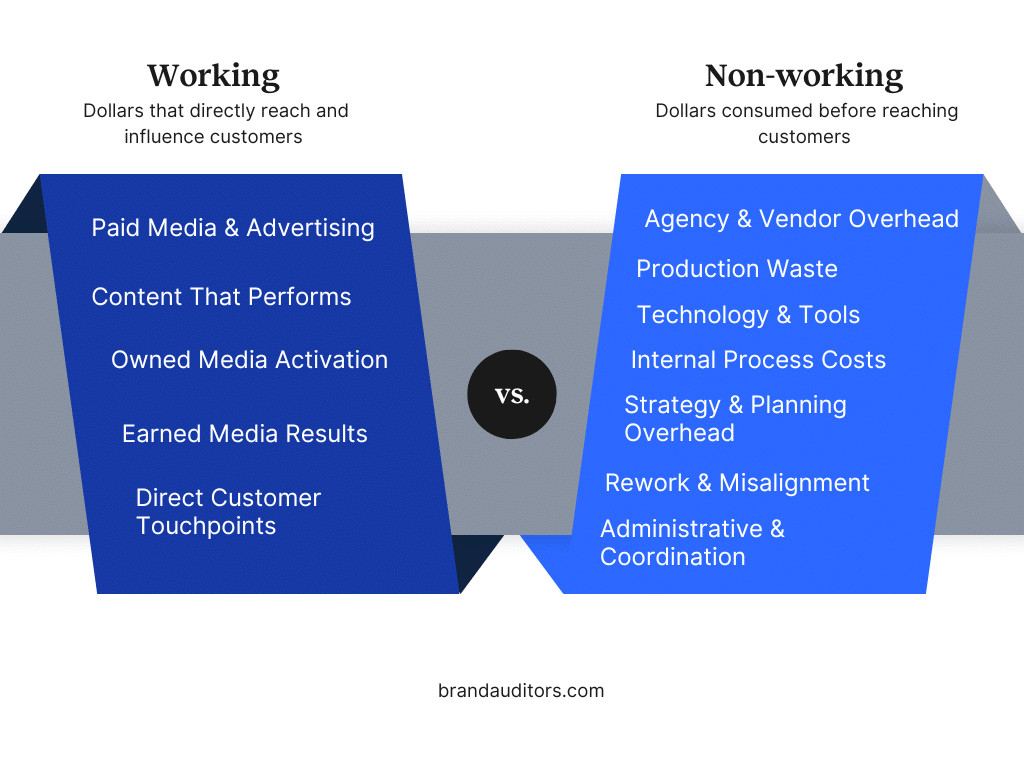

Optimize marketing for capital efficiency

Your marketing budget is real money with real expectations for return. Yet many companies at the $10 million or higher annual revenue scale still run marketing like a startup. They experiment with everything, measure nothing useful, and spread the budget too thin.

Focus on three metrics that matter: cost per qualified lead, channel-specific win rates, and 12-month revenue per marketing dollar.

Many of our clients tell us they must be visible on a channel because “that’s where our competitors are.” While that may be true in some cases, we find that most of our clients’ competitors aren’t successful on those channels, which means following them is a mistake.

Content marketing as a competitive moat

Successful small business growth strategies should include content that demonstrates expertise. Examples of this content are proprietary research only you can publish, benchmark reports with real data from your customer base, implementation frameworks from actual projects, and strategic guides that buyers can’t find anywhere else.

This content attracts potential customers before they go into active buying mode. Potential customers find you through search, consume your content, and form opinions about your expertise before contacting sales.

A successful content marketing strategy shortens sales cycles through pre-education and supports premium pricing through demonstrated expertise.

Focus on developing content around specific customer problems and show how you can solve them using your expertise. Generic topics generate traffic without conversion, but niche topics generate a qualified sales pipeline.

Budget allocation at scale

In this section, we’ll take a look at a budget allocation model based on 2025 B2B marketing benchmarks for companies scaling demand generation, pipeline influence, and retention.

Each channel’s investment and payback target is within industry norms.

| Channel | Monthly Budget | Strategic Role | Verified Benchmark Alignment |

|---|---|---|---|

| Paid Search | $12K | Scale proven demand | Benchmarks show paid search often receives 25-30% of demand gen budget. It is standard for high-intent channels to target payback under 6 months. |

| Vertical Content & SEO | $8K | Build category leadership. | SEO/content typically receives 15-20% of budget. A key metric is influenced pipeline; 9-month payback is realistic for organic channels. |

| Account-Based Marketing | $7K | Drive enterprise expansion | ABM spend ranges from 10-15% depending on ACV. 12-month payback aligns with long-cycle enterprise deals. |

| Strategic Partnerships | $6K | Generate channel revenue. | Channel marketing often receives 10-12% of budget. A valid metric is partner-sourced ARR; 8-month payback is achievable. |

| Email & Automation | $4K | Drive expansion revenue | Email/automation typically gets 5-10%. Net revenue retention is a leading metric. 3-month payback is aggressive but feasible. |

| Video & Webinars | $3K | Product education | Video/webinars often receive 5-8%. A common indirect ROI measure is sales cycle reduction. |

This allocation reflects a balanced mix of acquisition, expansion, and enablement. It is especially well-suited for companies with:

- $5M-$20M annual revenue

- Annual contract value between $10K and $50K

- Multi-channel GTM strategies

The payback periods align with current expectations for pipeline velocity and retention ROI.

Notice the pattern. There’s heavy investment in proven demand capture, systematic investment in organic authority, and controlled spending on expansion channels. This is a strategic allocation approach based on documented performance.

You must review channel performance weekly using a unified data model connecting spend to closed revenue, not pipeline creation.

Sources for the recommendations above:

- Benchmarkit 2025 B2B Marketing Benchmarks

- Forrester B2B Budget Allocation Insights

- The B2B Labs: 2025 Marketing Metrics

Build a sales funnel that converts

A funnel filled with prospects who aren’t a good fit for the company’s product or service can’t be fixed by a talented sales team. They’ll work twice as hard to close half as many deals, burn out faster, and accept the blame for what is actually a targeting problem.

The solution starts with your sales funnel, which is the entire system from initial targeting to closed revenue.

Get this right and sales execution improves dramatically. Get it wrong and even your best reps will struggle to close deals.

Supercharge the sales process with Ideal Customer Profiles (ICPs)

Most companies think they have an ideal customer profile (ICP), but what they actually have is a vague description like, “mid-market companies in healthcare” or “homeowners over 40 years old.”

That’s not an ICP. That’s a market segment-and a vague one at that.

A real, in-depth ICP defines your ideal customer with operational precision that guides every targeting, qualification, and sales decision.

An ICP qualifies your most profitable customers using:

Firmographic criteria include industry, company size, revenue range, geographic location, growth stage, and technology stack.

Be specific. “Healthcare providers” is too broad. An ICP is “Ambulatory surgery centers with 3-8 locations, $15M-$60M in revenue, operating in states with specific compliance requirements.”

Behavioral signals are triggers that prompt people to start looking for a solution. Here are some examples:

- Struggling with regulatory changes

- Trouble achieving growth milestones

- Having technology failures

- In a leadership transition

- Being outperformed by competitors

When you know the trigger, you can target customers experiencing it.

Budget authority: It’s critical to target the person who holds purchasing power. You must also know their typical budget range.

For business-to-business brands, you should know their procurement process. Is it a single decision-maker or committee? Do they require RFPs, vendor assessments, or legal review?

Decision timeline: Assess how urgent it is for the customer to solve their problem.

Are they in active evaluation mode or just exploring? What fiscal constraints or seasonal factors affect their buying timeline?

Pain tolerance and sophistication: How acute is the customer’s pain? Are they experiencing daily problems or looking for marginal improvements?

What’s their knowledge level? Do they know enough about your product or service to make a buying decision or do they need extensive education to understand it?

Success patterns: Look at your best customers-the ones who were satisfied with the product, bought again or expanded usage, and referred others. What do they have in common? Those commonalities define your true ICP, not your aspirational one.

If you serve meaningfully different customer types, build 2-3 distinct ICPs. Focus on determining which one(s) drives the most profitable, efficient growth. That’s where you should concentrate resources.

A refined ICP improves conversion rates across your entire funnel. When you talk to the right buyers at the right time with the right problem, everything else gets easier.

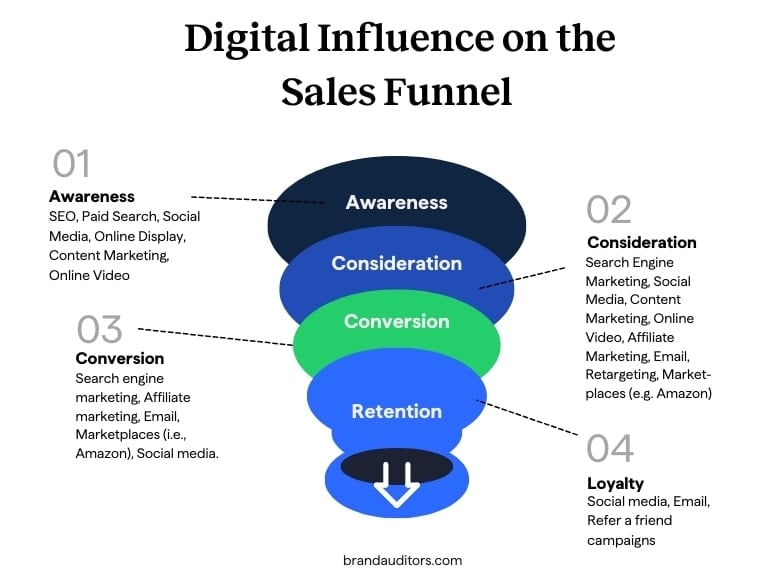

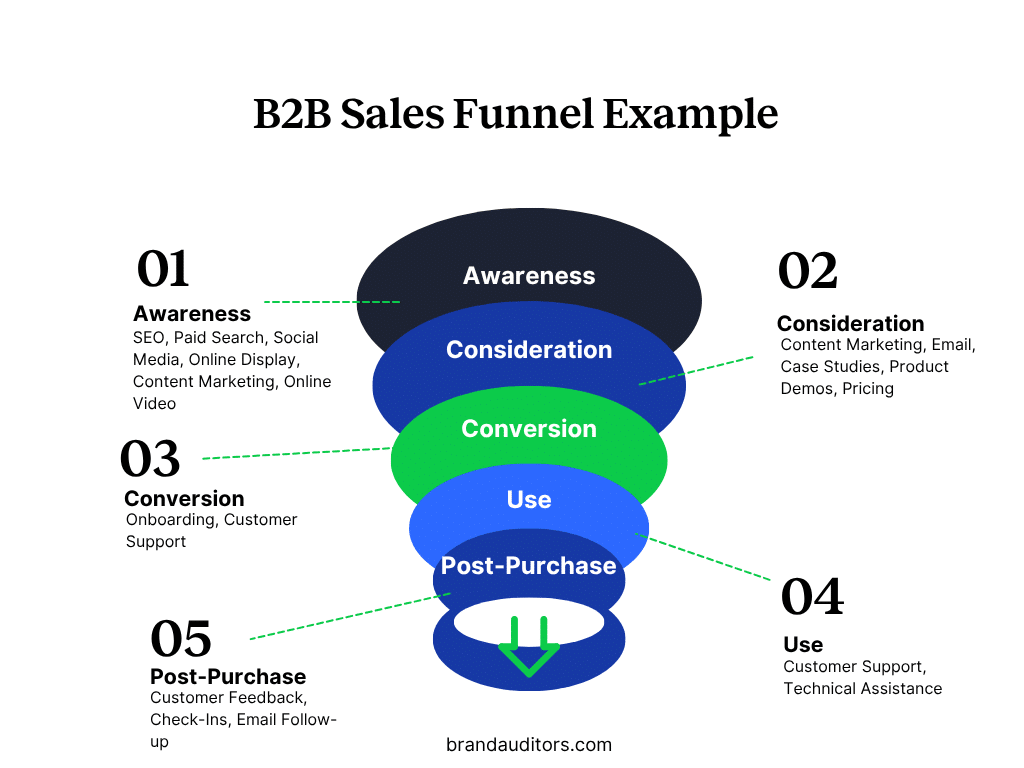

Map and Optimize Your Sales Process (B2B) or Conversion Funnel (B2C)

Once you’re attracting the right prospects or customers, your process determines whether they buy from you. At your scale, you need to use a proven methodology that converts efficiently and scales predictably.

For B2B businesses with sales teams:

Map your buyer journey with clear stage definitions, exit criteria, and required evidence at each stage: discovery, qualification, value alignment, commercial proposal, legal, close. Each stage must have specific outcomes that must be achieved before advancing.

Discovery means understanding their current state, desired outcomes, key stakeholders, decision process, timeline, and budget reality. Exit criteria: you can articulate their business problem better than they can, and they’ve confirmed you understand it correctly.

Qualification means validating they match your ICP, have budget and authority, recognize the problem as urgent enough to solve now, and your solution can deliver the outcomes they need. Exit criteria: mutual agreement that there’s a fit worth exploring, with specific next steps scheduled.

Value alignment means connecting your solution to their specific business outcomes with quantified impact. It does not mean features and benefits, but actual results expressed in their language with their metrics. The exit criteria is when the economic buyer confirms the value justification works for their business case.

A commercial proposal means presenting pricing, terms, and implementation approach that align with their decision process and risk tolerance. Exit criteria: no surprises in the proposal, pricing is within expected range, terms are acceptable, and timeline is realistic.

Legal means working through contracts, security reviews, compliance requirements, and vendor onboarding. Exit criteria: all stakeholders have approved, contracts are executed, and implementation kickoff is scheduled.

For B2C businesses with transactional models:

Map your customer journey with clear stages and conversion optimization opportunities: awareness, consideration, evaluation, purchase, post-purchase. Each stage has specific metrics and friction points to address.

Awareness means customers discover your brand through search, social, content, ads, or referrals. The key metrics are traffic sources, cost per click, impression share, and brand search volume. Optimization involves improving discoverability through SEO, paid acquisition efficiency, and brand-building content.

Consideration means customers are actively evaluating whether your product solves their need. Key metrics include time on site, pages per session, product page views, and add-to-cart rate. Optimization includes improving product content, photography, specifications, social proof (reviews, ratings, UGC), and comparison tools.

Evaluation means customers are deciding between your product and alternatives, or considering whether to buy at all. Key metrics include cart abandonment rate, exit pages, and price comparison behavior. Optimization involves addressing objections through guarantees, return policies, shipping transparency, customer service availability, and financing options.

Purchase means customers are completing checkout. Key metrics are checkout abandonment rate, payment success rate, and average order value. Optimization includes simplifying checkout flow, offering multiple payment options, displaying security badges, showing shipping costs upfront, and enabling guest checkout.

Post-purchase means customers receive and use the product. Key metrics include delivery satisfaction, return rate, first review timing, and repeat purchase rate. Optimization includes improving packaging experience, sending usage guidance, requesting reviews at optimal timing, and offering complementary products.

The principle is the same for both models: document what works, identify where prospects drop off, test improvements systematically, and scale what converts.

Train sales to sell outcomes, not features

Value is contextual, not feature-based. A feature that solves one company’s problem might be irrelevant to another’s situation.

Require reps to use discovery frameworks that uncover current state, desired future state, cost of maintaining status quo, and decision timeline before presenting any solution.

Connect your offerings to specific business outcomes: risk mitigation, revenue enablement, cost reduction, or compliance achievement. Quantify the impact. “Reduces compliance audit time by 40%” is more compelling than “automated audit workflows.”

Use systematic close processes that confirm decision-making authority, approval process, timeline, and success criteria at every stage. Establish clear next steps on every call. Ambiguous endings kill deals because momentum dies and competitors fill the vacuum.

Implement your CRM as system of record

Your CRM should provide complete visibility into sales operations, not just contact management. Define stage progression criteria, required data fields, and automated workflows that enforce your methodology.

Track leading indicators that predict performance. These include outreach velocity, meeting-to-opportunity conversion, stage progression rates, discount frequency, and competitive win/loss patterns. These metrics reveal problems before they show up in revenue.

Systematically diagnose performance issues

When conversion rates decline, diagnose the root cause before applying solutions to symptoms.

Poor fit? Tighten ICP criteria and qualification methodology. You might be attracting the wrong prospects or advancing poor fits too far into your funnel.

Weak proof? Add customer case studies with quantified outcomes that match your prospects’ situations. Generic case studies don’t work-buyers need to see themselves in the story.

Slow response? Speed matters. Responding in 2 hours instead of 24 hours often determines who wins the deal.

Price confusion? Simplify packaging and pricing communication. If buyers struggle to understand your pricing, they will default to cheaper, simpler alternatives.

Competitive loss? Strengthen differentiation and positioning. If you’re losing on price, you’re losing on value communication first.

Systematic improvement of conversion rates produces outsized returns compared to increasing top-of-funnel volume. For example, improving from 40% to 45% win rate on 100 qualified opportunities generates 5 more deals. This is the equivalent of generating 12.5 additional qualified opportunities through marketing.

Fix your funnel before you scale it. Otherwise, you’re spending more money to generate the same disappointing results faster.

Scale business operations without breaking them

Two companies in the same industry, with the same revenue and the same growth rate. One sells for 8x EBITDA (Earnings Before Interest, Taxes, and Amortization). The other sells for 4x.

The difference is operational maturity. The 8x company had documented processes, automated workflows, clean data, and systems that could scale without the founder. The 4x company ran on tribal knowledge, manual processes, and key person dependencies.

Both made money. Only one was investable.

Document every process, workflow, and system to the point where a qualified professional can execute it without direct training from the original creator. Map critical workflows showing how work moves, who touches it, decision points, approval requirements, and quality gates.

Build leadership

Founders at the $10M+ annual revenue stage often wait too long to build the leadership team. They keep executing, selling, and delivering. They are the bottleneck for every major decision in every important meeting, working 70-hour weeks.

Then growth accelerates and everything breaks.

Founder-led execution models don’t scale. Your constraint isn’t hours in the day; it’s leadership leverage.

You need executives who can run entire functions without your daily involvement. Not senior individual contributors. Not managers who might grow into the role. Actual executives who have done this before.

- The VP of Sales is accountable for revenue attainment, sales methodology, team development, and pipeline predictability.

- The VP of Marketing drives demand generation, category positioning, customer acquisition economics, and brand strategy.

- The VP of Operations ensures service delivery, process excellence, quality metrics, and operational leverage.

- The VP of Customer Success owns retention, expansion revenue, product adoption, and customer health.

High-performing individual contributors rarely make effective first-time managers without support. The skills that made them successful-deep expertise, personal execution, technical mastery-differ from leadership skills like delegation, coaching, strategic thinking, and team development.

Align compensation to outcomes

Executive compensation should reflect both foundational leadership and measurable business impact. A common approach is a base salary plus performance-based incentives, where the variable component is tied to outcomes that go beyond surface-level activity metrics.

Effective incentive structures focus on value-driving metrics rather than rewarding volume alone (i.e., leads generated, bookings made, or tasks completed):

- Not just initial sales activity, but revenue growth and retention.

- Not just lead volume, but also pipeline contribution and customer acquisition efficiency.

- Customer retention and expansion, not just satisfaction scores

- Operational leverage and margin improvement, not just delivery throughput.

This alignment ensures that executives are incentivized to drive sustainable, high-quality outcomes that support long-term growth and profitability.

Manage for enterprise value

At $10 million+ revenue, financial management shifts from survival to optimization. At this point, you focus on maximizing capital efficiency, defending margins, funding strategic investments, and building financial infrastructure that survives due diligence.

Revenue growth alone doesn’t drive valuation. Quality of earnings does. Buyers and investors scrutinize specific metrics, and the exact metrics vary by business model.

Let’s look at some examples.

For B2B businesses (especially with recurring revenue)

- Net Revenue Retention (NRR) above 110% proves expansion from existing customers funds growth. This indicates you can grow even without adding new customers, showcasing strong product-market fit and customer loyalty.

- LTV:CAC Ratio above 3:1 validates unit economics that support scale. This means you make back three times what you spend to acquire customers, signaling a sustainable and profitable acquisition strategy.

- CAC Payback Period under 12 months limits capital requirements for growth. You recoup acquisition costs quickly enough to fund continued expansion, improving cash flow and reducing reliance on external funding.

- Gross margin above 60% for software or 40% for services funds growth investments and signals scalability. Higher gross margins provide more capital to reinvest in product development, sales, and marketing.

- Rule of 40 (revenue growth rate plus EBITDA margin exceeding 40%) balances growth and profitability. This metric is a strong indicator of a healthy SaaS business, demonstrating efficient growth.

Sources:

- Wudpecker.io (2025 Retention Benchmarks): Top-performing B2B SaaS companies achieve NRR >120%, with a median of 106%. Larger firms ($100M+ ARR) report median NRR of 115%, confirming that expansion revenue drives growth without new customer acquisition.

- GetMonetizely (2025): Tomasz Tunguz of Redpoint Ventures recommends a minimum LTV:CAC ratio of 3:1 for sustainable SaaS growth. Ratios below 1:1 are unsustainable, while 3:1 or higher signals efficient acquisition and strong profitability.

- Lighter Capital (2025): Industry benchmarks show the median CAC payback period for public SaaS companies is ~12 months, with shorter periods indicating stronger capital efficiency.

- CloudZero (2025): SaaS companies with gross margins ≥85% are considered highly efficient. Margins above 60% are typical for software-only models, while services often operate around 40% due to labor intensity.

- SaaS Capital (2025): The Rule of 40 remains a key benchmark for evaluating SaaS health. Companies exceeding 40% are considered attractive to investors and capable of scaling efficiently.

For B2C businesses

- A repeat purchase rate above 40% within 12 months proves product-market fit and reduces dependency on expensive new customer acquisition. This highlights customer satisfaction and brand loyalty.

- LTV:CAC ratio above 3:1 validates your acquisition strategy is sustainable. Track this by channel and customer cohort to optimize marketing spend.

- For transactional businesses, the CAC payback period is under 6 months, and for higher-ticket items, it is under 12 months. Faster payback means less capital required to fuel growth, enhancing financial agility.

- Gross margin above 50% for products and above 65% for digital goods provides room to invest in brand, customer experience, and growth. These margins allow for strategic reinvestment to build a strong market presence.

- Contribution margin after marketing above 20% proves unit economics work at scale. This is calculated as revenue minus Cost of Goods Sold (COGS) minus marketing costs, divided by revenue, demonstrating the profitability of each sale after direct costs.

Sources:

- Mobiloud (2025 Ecommerce Benchmarks): Repeat purchase rates vary by category, but consumables and beauty products can exceed 40% with strong retention strategies.

- Harvard Business School Online (2025): A ratio of 3:1 or higher is considered attractive and scalable for consumer businesses.

- Wall Street Prep (2024): Viable B2C startups target CAC payback periods under 12 months, with faster payback improving liquidity.

- Opensend (2025): Ecommerce gross margins typically range from 40–80%, with digital goods and DTC brands often exceeding 65%.

- Corporate Finance Institute (2025): CMAM is calculated as revenue minus COGS and marketing expense. A margin above 20% indicates profitability after direct costs.

Universal metrics for both models

These metrics determine your enterprise value multiple regardless of whether you’re B2B or B2C:

- Customer concentration risk reduces concentration risk if less than 20% revenue comes from top 10 customers (B2B) or top 10 geographic/channel sources (B2C). Diversified revenue streams indicate a more stable and resilient business.

- Margin sustainability: Over 8 quarters, gross margins stable or improving proves your unit economics aren’t degrading as you scale. Consistent or increasing margins signal efficient operations and pricing power.

- Operating leverage shows you’re scaling efficiently without proportional overhead increases, as General & Administrative (G&A) expenses as a percentage of revenue are declining. This indicates that your fixed costs are being spread across a larger revenue base.

These metrics collectively determine your enterprise value multiple and acquisition readiness, providing a comprehensive framework for financial health and strategic growth.

Sources:

- Exitify (2025): Businesses with no customer exceeding 10% of revenue often command premium multiples (4–6× EBITDA), while those with >20% face significant discounts (2.5–4× EBITDA).

- FasterCapital (2025): Gross margin trends are a litmus test for production efficiency and long-term profitability. Stable or improving margins signal healthy unit economics and investor readiness.

- Drivetrain.ai (2025): G&A efficiency is a key lever of operating margins. Top-performing companies ensure G&A grows slower than revenue, improving enterprise value.

Quality of earnings

Growth rate gets attention, but quality of earnings drives valuation.

Revenue quality

Consider revenue quality as the foundation of your business’s financial health. You want to show investors that your revenue is diversified, predictable, and built on real demand and not just price hikes.

This means spreading revenue across a healthy customer base (so you’re not overly dependent on a handful of accounts), maintaining strong recurring revenue, demonstrating that growth comes from actual volume increases, and securing multi-year contracts with clear renewal patterns.

Margin sustainability

Sustainable margins tell the story of whether your business model works at scale. You’re looking for gross margins that hold steady or improve over time, sales and marketing efficiency that gets better as you grow, and General and Administrative Costs (G&A) that shrink as a percentage of revenue. This operational leverage proves you’re building a machine that gets more efficient.

Keep this discipline front and center, even when you’re in hypergrowth mode. Clean financials directly impact your valuation.

Cash reserves

You should be sitting on 6-9 months of operating expenses in reserves. That’s higher than what early-stage companies need, but you’re playing a different game now with bigger burn rates and more exposure. This cushion protects you when customers delay payments on large contracts, when competitive pressure forces pricing decisions, when key people leave and need replacing, or when market conditions shift unexpectedly.

Keep these reserves liquid and safe: money market funds, treasury bills, high-yield savings accounts. This is working capital-don’t tie it up in anything you can’t access quickly.

Sources:

- Forbes Business Council (2025): Quality of Earnings (QoE) reports are increasingly used in M&A to validate financial health and justify valuation multiples. Buyers rely on QoE to assess sustainability and reliability of earnings.

- The Precision Firm (2025): Distribution businesses with 30–60% recurring revenue earn 0.5x–1.5x EBITDA higher than peers. Buyers prioritize contract-backed revenue for its predictability.

- Bain & Company (2025): Sustainable profitable growth requires margin durability and efficient commercial investment.

- Accounting Insights (2025): Liquidity buffers are essential for financial stability and operational continuity.

Fund strategic growth

Prioritize capital deployment to initiatives that compound returns. This includes product development features that reduce churn by 2% or increase average contract value by 15%+, sales capacity when CAC payback is under 12 months and you have unfilled pipeline, marketing programs with proven CAC payback under 12 months and scalable volume, and operational leverage through technology and automation with documented payback under 18 months.

Before committing full budgets, run controlled pilots. Set clear success criteria and kill-or-scale decision points at 90 days.

Focus on seven core metrics that determine enterprise value:

- Net Revenue Retention > 110%

- LTV:CAC Ratio > 3:1

- CAC Payback < 12 months

- Gross Margin > 60% (SaaS) or > 40% (services)

- Rule of 40 > 40%

- Revenue Concentration < 20% from top 10

- Recurring Revenue > 70%

These metrics should guide your operational decisions and financing strategy, whether you’re considering revenue-based financing, traditional debt, or equity capital.

Sources:

- Product features that reduce churn or increase ACV:

- SaaS Capital: How to Reduce Churn – Feature enhancements tied to customer success reduce churn and increase expansion revenue.

- OpenView Partners: ACV Expansion – Increasing ACV through upsell/cross-sell is a key driver of Net Revenue Retention.

- CAC payback under 12 months:

- Wall Street Prep: CAC Payback Period – Payback under 12 months is a benchmark for scalable growth.

- Marketing programs with scalable CAC:

- SaaStr: CAC Payback and Growth Efficiency – Efficient marketing programs show CAC payback under 12 months and scale with volume.

- Automation with <18-month payback:

- McKinsey: Automation ROI – Digital automation initiatives with payback under 18 months are prioritized for operational leverage.

- Harvard Business Review: Scaling Pilots – Pilots should be time-boxed with clear metrics and kill-or-scale decisions.

- Six Sigma Study Guide: Pilot Testing – 90-day pilots with defined success criteria reduce risk and improve implementation outcomes.

- Forbes: Revenue-Based Financing – Flexible, non-dilutive capital tied to revenue performance.

- Lighter Capital: Venture Debt vs. Equity – Venture debt extends runway between equity rounds.

- Brex: Choosing the Right Capital – Compares revenue-based financing, traditional debt, and equity for different growth scenarios.

- SaaS Capital: 2023 SaaS Benchmarks – NRR, CAC payback, and recurring revenue benchmarks.

- Aventis Advisors: SaaS Valuation Metrics – Rule of 40, gross margin, and revenue concentration impact on valuation.

- FE International: SaaS Exit Readiness – Key metrics that drive enterprise value and exit multiples.

Build expansion revenue by boosting customer retention

The cost of acquiring new customers is greater than the investment in increasing the value of existing customers.

According to Forbes Business Council, “Depending on the industry you are in, acquiring a new customer can cost five to seven times more than retaining an old one.”

This is especially true in Software as a Service (SaaS) and ecommerce, where retention strategies significantly reduce acquisition costs.

These findings show how important customer retention is in driving profitability and capital efficiency. Yet most companies focus primarily on new customer acquisition.

At scale, existing customers should fund your growth. New customer acquisition becomes more expensive while expansion from or repeat business with existing customers becomes more profitable.

Customer insights that drive strategy

Your customer insights become the cornerstone of strategic decisions. They systematically guide your product roadmap, shape competitive positioning, and validate market expansion opportunities.

Gaining strategic B2B customer intelligence

Systematically gather customer intelligence through quarterly business reviews with your top 20% of customers. Focus on achieved outcomes and strategic alignment.

Then, conduct structured win/loss analysis on every deal above $50K to identify key decision factors. Interview churned customers within 7 days of departure to understand root causes. Perform monthly cohort analysis to uncover adoption patterns and identify expansion opportunities early.

Customer insights in business-to-consumer (B2C)

Build systematic customer feedback loops that drive strategy:

1. Survey the post-purchase experience within 48 hours and track satisfaction metrics by shared customer characteristics (cohort analysis).

2. Conduct quarterly interviews with your top 20% highest-lifetime value (LTV) customers to understand what drives their loyalty and repeat purchases.

3. Run monthly churn analysis segmented by product type, acquisition channel, and initial purchase value.

4. Monitor product reviews and social mentions daily, categorizing both positive drivers and friction points.

This feedback cycle should directly inform your product roadmap, competitive positioning, and go-to-market strategy. It’s strategic intelligence, not just customer service data.

Execute with strategic intent

Growth at $10M+ revenue happens by building a competitive advantage and enterprise value. The decisions you make today about market positioning, capital allocation, and organizational design determine whether you scale efficiently.

Only 15% of high-growth companies maintain their position for 30 years. The difference is strategic discipline.

Define your strategic framework

Document three interconnected decisions that govern everything else:

Growth rate target: How fast to grow based on market opportunity, competitive dynamics, and capital efficiency. A 25% growth target with improving unit economics beats 50% growth with degrading margins.

Market positioning: Where to compete and where explicitly not to compete. Defending a strong position beats expanding into weak ones.

Capability investment: Which people, systems, and processes to build that support your growth rate and positioning.

A framework like this makes decisions simple.

Align strategy with exit objectives

If you’re building for strategic acquisition, emphasize market leadership in a defined category, product integration opportunities with likely acquirers, and technology moats.

If you’re building for private equity, focus on predictable recurring revenue, margin expansion opportunities, and a management team that can run without you.

Your growth strategy should align with your exit strategy from day one.

Track what predicts success

Measure business quality, not just size. Track net revenue retention (or repeat purchase rate for B2C), gross margin improvement, customer acquisition cost (CAC) payback trend, and revenue per employee.

Set targets by customer cohort: 90% 12-month retention, above 120% net retention for B2B or 40%+ repeat rate for B2C, under 0.3% complaint rate per 1,000 interactions.

These metrics predict sustainable growth and enterprise value.

Review strategy quarterly

Market dynamics at your scale move faster than annual planning. Quarterly reviews catch competitive pattern changes before they impact revenue, customer behavior shifts while you can adapt, and margin trends early enough to correct course.

The suggested targets align with best-in-class benchmarks:

- 90% 12-month retention is achievable in high-value B2B segments and signals strong onboarding and product engagement.

- Net revenue retention (NRR) >120% reflects expansion revenue through upsells, cross-sells, and renewals.

- Repeat purchase rate >40% is common in high-frequency B2C categories like beauty, food, and health.

- A complaint rate of <0.3% per 1,000 interactions is a reasonable benchmark for customer experience quality, especially in regulated or service-intensive industries.

These metrics are tied to enterprise value and exit readiness:

- Investors and acquirers prioritize predictable, diversified, and efficient growth.

- Valuation models and diligence scoring use metrics like NRR, CAC payback, and margin trends.

Sources:

- SaaS KPIs 2025: The Metrics That Predict Growth and Retention

- 2025 SaaS Performance Metrics | Benchmarkit

- 2024 B2B SaaS Performance Metrics Benchmarks Report

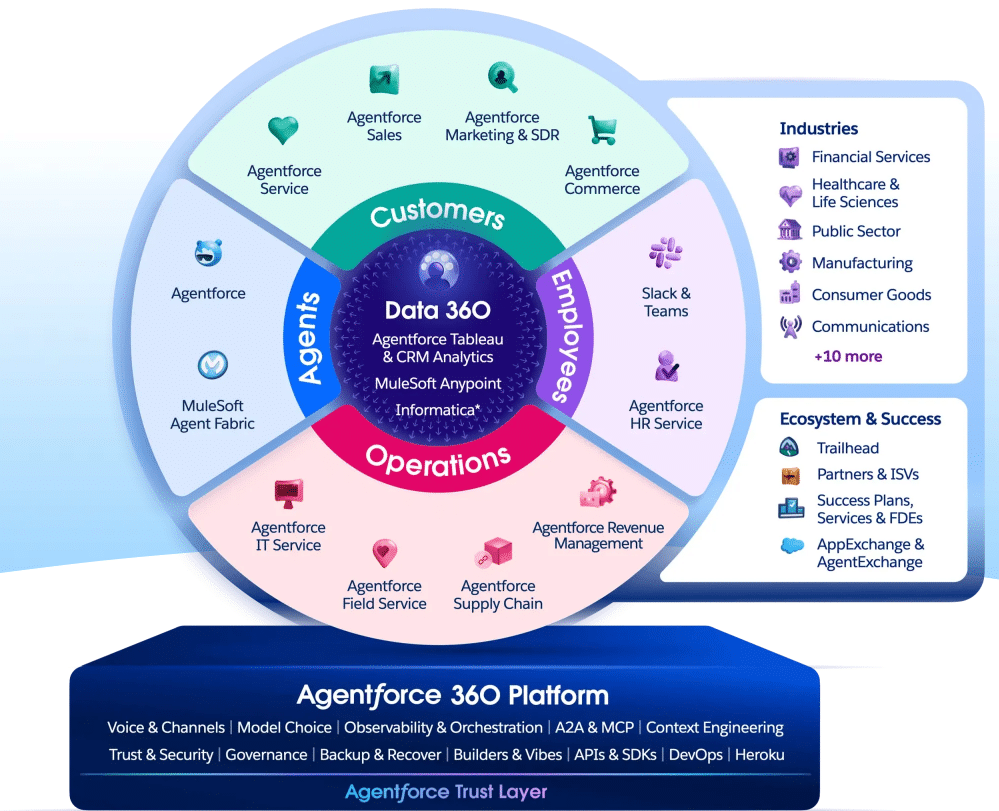

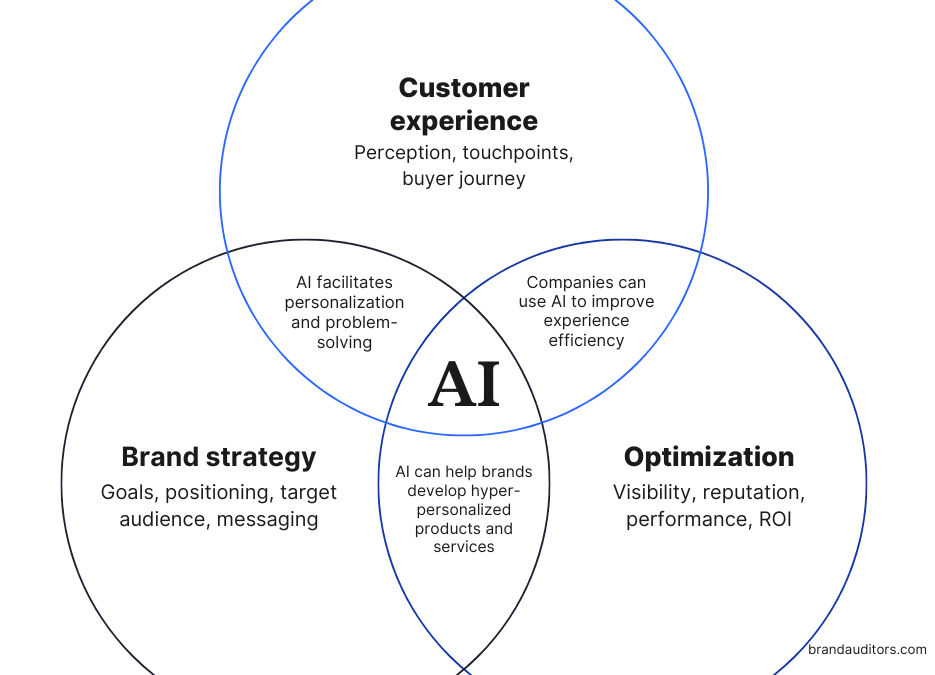

Invest in artificial intelligence (AI)

AI adoption creates operational leverage that compounds into competitive advantage. The companies implementing AI effectively now will operate with 20-30% better efficiency within 12 months—lower costs, faster response times, and leaner teams.

Where to apply AI immediately:

AI handles repetitive work at scale. Customer support automation answers common inquiries 24/7. Data analysis tools surface churn risks and expansion opportunities from thousands of customer interactions. Content generation accelerates marketing and sales output. Sales intelligence analyzes calls to identify winning patterns and prioritize high-value leads.

These are proven tools that deliver measurable ROI within 90 days.

Why timing matters:

Your competitors are implementing AI right now. The ones who move first compound efficiency gains quarterly while others fall behind. The window for “wait and see” has closed. AI has moved from experimental to essential.

Start with three high-impact areas:

First, implement AI customer support for common inquiries—typically pays back in 60-90 days. Second, deploy AI for customer data analysis to identify revenue opportunities. Third, use AI to accelerate high-volume content needs, freeing your team for strategic work.

Don’t implement everywhere at once. Start with highest-impact, lowest-complexity use cases. Learn what works. Then expand systematically. The companies that win at your scale will augment their teams with AI effectively, creating leverage that pure headcount can’t match.

Re-engineering your path to defensible growth

The most common structural failures that sink companies that make over $10 million annually are competitive erosion, scaling complexity, and margin compression.

These issues are often misdiagnosed.

Leaders attribute these challenges to market shifts or execution gaps, when the real problem is a failure of strategic consistency.

You’ve built a machine that works. For sustainable growth, you need to stop running the machine and start re-engineering its blueprints.

The failure of commitment and consistency manifests at the executive level here: not in daily tasks, but in the systematic, disciplined adherence to the three pillars of defensible growth we discussed:

1. Validating your positioning each quarter.

2. Building operational capacity ahead of volume.

3. Tracking quality of earnings over revenue size.

When these structural disciplines are abandoned (i.e., the quarterly audit, delay the operational redesign, or chase vanity metrics), structural failures are inevitable. The lack of commitment to the new standard is the behavioral mechanism that undermines the defensible strategy.

You have the roadmap and the talent. What is often missing is the objective, third-party diagnostic to enforce the required strategic pivot and commitment.

That’s where The Brand Auditors comes in. We provide you and your team with diagnostic work that:

- Validates unit economics by customer segment.

- Gives you an objective view of your true competitive position (not the aspirational one).

- Prioritizes an action plan to close your enterprise value gaps before growth forces your hand.

At your scale, growth is a choice between expensive chaos and defensible profitability. Choose the latter.

Ready to learn more?

Connect with a strategist for a no-obligation session designed to pinpoint your brand's biggest opportunities and get a clear path to successful outcomes.

POST AUTHOR

Core services

Digital marketing

audit services

Discover how to improve marketing campaigns, strengthen the impact of every customer touchpoint, and focus resources on the actions that generate more revenue.

Customer experience strategy consulting

Turn raw customer data into audience personas and laser-focused messaging.