Competitive Landscape Analysis for Premium Brands

Discover how competitive landscape analysis can elevate premium brands, providing insights to differentiate your business and enhance market positioning effectively.

February 28, 2025

Key takeaways

- Competitive landscape analysis helps premium brands balance exclusivity and profitability.

- Frameworks like SWOT analysis and Porter’s Five Forces can help organizations get a reliable evaluation of competitive dynamics.

- A business can adjust its marketing strategy and product development based on competitive insights.

Premium brands have a tough assignment: they must be competitive while maintaining a sense of exclusivity.

Brand development in today’s business environment takes more than great products. Companies can’t afford to get complacent. They must constantly track competitors, market conditions, and customer expectations.

Competitive landscape analysis guides a business’ strategy. It helps premium brands stay agile, leverage new opportunities, and make smarter strategic decisions.

How to conduct competitive landscape analysis

Companies use the competitive landscape analysis process to explore market dynamics within their sectors and evaluate rivals’ strategies. The practice includes reviewing competitors’ websites, social media, content marketing strategy, offerings, pricing, and other factors. Benchmarking performance is also possible using the insights from an analysis.

The value of competitor analysis isn’t theoretical. A recent State of Competitive Intelligence Report by Crayon found that 61% of companies surveyed found that having competitive insights has a positive impact on revenue.

Steps for effective analysis

Competitive analysis begins internally. Organizations should start by clarifying how competitor assessment will help them improve their business strategy.

An objective self-assessment is a key part of this step. Business leaders should spend some time in self-reflection to evaluate how aligned the company currently is with its mission and unique value. This gives brands a chance to “get their bearings” before analyzing the competitive landscape.

Direct competitors are those who offer the same products to the same target audience. But you must also consider indirect competitors—the ones that influence your market in other ways.

Tertiary competitors are the easiest to overlook because they don’t compete directly with your company. However, they affect your brand by offering alternatives or solutions that can distract or confuse the people you want to reach.

For example, spreadsheets are cheaper (and messier) substitutes for CRM systems. Coffee is an alternative to soda. And streaming services are alternative for cable TV services.

To find competitors, look in adjacent market sectors to find companies that cater to similar needs or desires, even if they are in different industries.

Once you have a list of competitors, segment them into groups by similarities and differences.

- Gather as much information about the competition and the market as possible. Use data of all types—market research reports, customer surveys, analytics. Study what your competitors offer, their prices, and marketing messages.

- Review the data to find patterns and trends. Compare your findings to industry benchmarks. Visuals make the numbers easier to comprehend. Use the insights in this step to guide your competitive strategy.

- Monitor your industry. Competitive analysis is an ongoing process. Your strategies should be flexible to keep your company agile.

An example of identifying competitors

Let’s use the skincare brand Aesop to illustrate competitor identification.

Aesop’s direct competitors are companies like Le Labo and L’Occitane. But for a competitor analysis, Aesop would also have to consider an indirect competitor like MUJI, a lifestyle brand.

MUJI also offers skincare products (e.g., toners, cleansers, and lotions) that are priced more affordably, and does not position them as luxury items. This differentiates MUJI from Aesop’s premium products. MUJI could, however, capture potential Aesop consumers who prioritize aesthetics and minimalism but are less inclined to spend more on luxury skincare.

Hermès also offers skincare products, but is in the luxury category. However, Hermès is a tertiary competitor because the overlap is a shared lifestyle and consumer values (luxury, aesthetics, and design-consciousness) rather than direct competition in skincare or personal care. Hermès’ presence in this space enhances its broader luxury portfolio, while Aesop concentrates solely on dominating the personal care category.

Key analysis frameworks

Researchers have developed several frameworks to help clarify and organize competitive landscape analysis. We recommend using multiple frameworks if possible because each one has its own lens.

Organizations can expect to gain a more comprehensive perspective when using frameworks in tandem. For businesses that want a more targeted analysis, select the framework that aligns with your business needs.

SWOT framework explained

The SWOT framework is a simple but popular way to identify some of the most important internal and external factors that affect your business. It also identifies strengths to leverage and weaknesses to address.

Strengths and weaknesses are internal and impact the brand for better or worse. Opportunities and threats reveal clues about the external sources that provide a potential advantage or disadvantage.

The SWOT framework is an effective strategic planning tool that can help companies prevent missteps by aligning their internal capabilities with market opportunities and goals.

Porter’s Forces overview

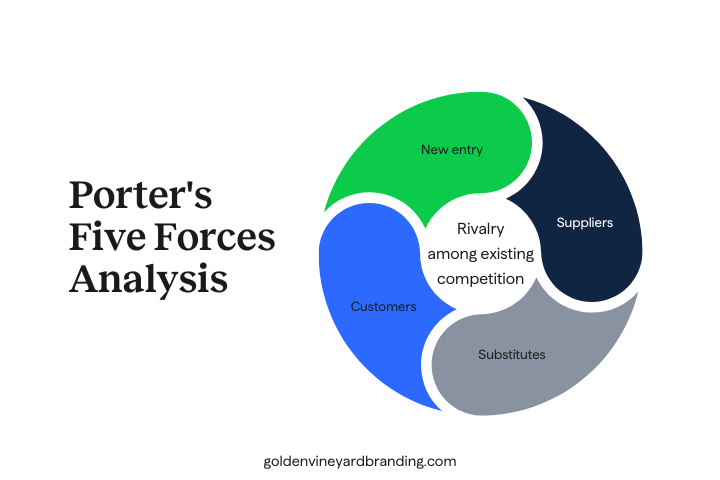

Michael Porter’s Five Forces framework, developed at Harvard Business School, is a popular competitive analysis tool. The model focuses on the factors that influence a market sector. Examples are competition, bargaining power of stakeholders, potential new entrants, and substitute products.

If a sector has strong competitive forces in these areas, it may offer lower profitability potential. Weaker forces suggest better profit potential.

PEST analysis simplified

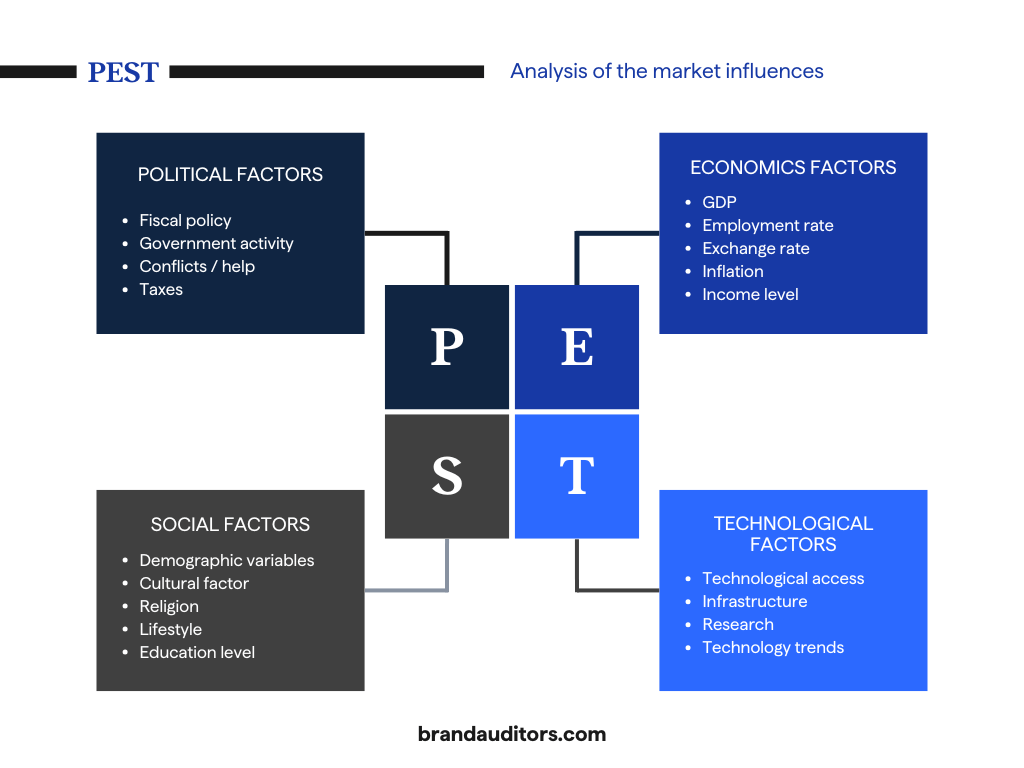

PEST analysis is a strategic framework that considers the external macro-environmental factors affecting businesses. The name is an acronym for Political (government policies, regulations), Economic (interest rates, economic growth), Social (demographic trends, cultural shifts), and Technological (innovations, tech adoption) factors.

Organizations use PEST analysis to understand broad external influences on their industry and adapt their strategies accordingly.

Growth-Share Matrix explained

The Growth-Share Matrix, or Boston Consulting Group Matrix, divides products or business units along the dimensions of market growth and share. This matrix helps businesses determine how to allocate resources and sharpen their strategic focus.

It also encourages them to evaluate their portfolio periodically to ensure smart investment decisions.

| Category | Description |

| Stars | High growth, high market share |

| Cash Cows | Low growth, high market share |

| Question Marks | High growth, low market share |

| Dogs | Low growth, low market share |

Strategic Group Analysis insights

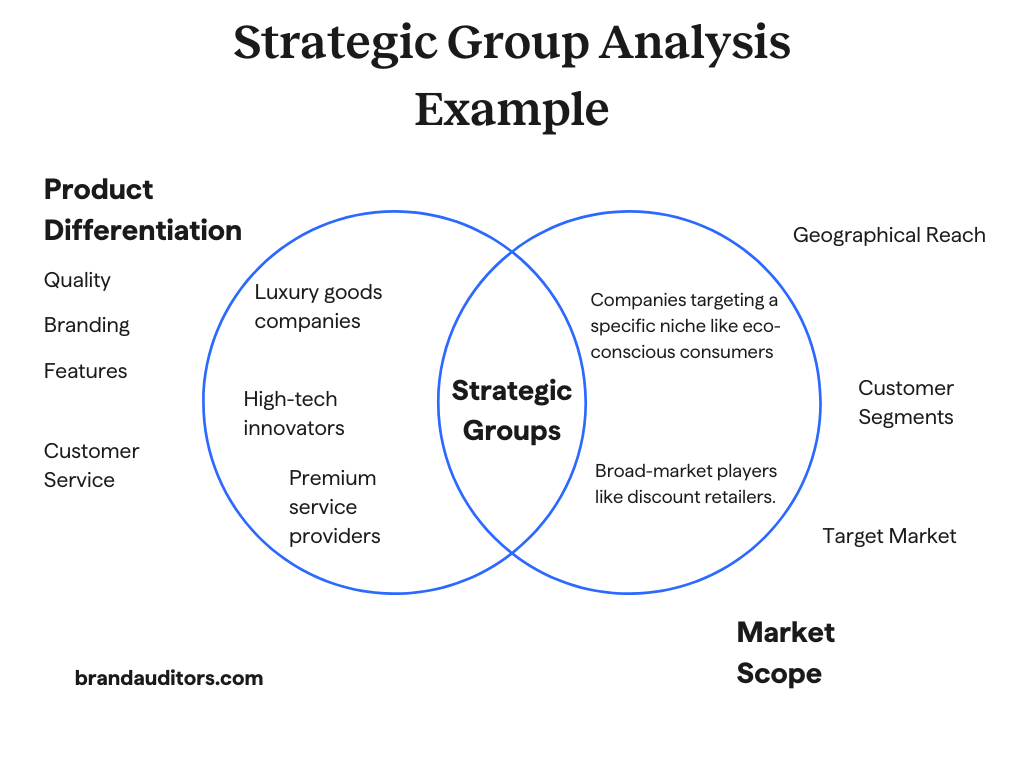

Strategic Group Analysis is a tool that maps organizations within an industry based on key competitive characteristics, like price, quality, or market reach. It helps identify direct competitors who follow similar strategies and reveals strategic opportunities by highlighting underserved market positions.

Companies use this analysis to understand their competitive landscape and potential areas for differentiation.

Market research sources for competitive data

Organizations need to pull data from various sources to get a reliable market analysis.

Analyze competitor websites

Competitor websites can tell you all about their products, services, pricing strategies, unique value propositions, and more.

When assessing a competitor’s website, start by reviewing the user experience and design quality. Glance over a few pages to get a sense of the site’s layout, color schemes, and aesthetic appeal. These influence the impact of the brand’s identity and conversion rate capability.

Product offerings and marketing messages are key pieces of the puzzle. Evaluate the range of products or services each competitor provides.

As you review competitor websites, note the characteristics that set them apart from other brands in the sector. For instance, if a competitor emphasizes sustainable sourcing or special customer service packages, they might aim for a particular segment of the target market.

Website analysis tools can make it easier to assess traffic levels and popular content pages. SEO analysis software can offer additional data on rivals’ keyword strategies, backlink profiles, and overall online visibility.

Monitoring updates and modifications to competitor websites can reveal shifts in their strategic approach. For instance, let’s say a competitor suddenly launches a new product line or revamps their branding. They might be doing this in response to market trends, a shift in brand direction, or a change in the target market.

Leverage social media insights

Using social media for competitive analysis can be incredibly valuable. But it’s easy to go down a rabbit hole when reviewing your rivals’ social media pages.

While engagement is good (i.e., likes and comments), it’s best to focus on customer segments and content topics competitors use to attract the target audience. These reveal popular topics and offers, posting schedules, and potential untapped segments. As a result, businesses can figure out to allocate advertising dollars without wasting time and money on trial and error.

Companies can also learn from their competitors’ successes and mistakes. Instead of copying what others do, you can carve out your unique space in the market while making smart, data-backed decisions about your social media investments.

Conduct customer interviews

The best way to understand buyer perceptions is to ask them. Customer interviews help businesses refine their competitive positioning. Getting accurate data is not always easy.

Organizations must have a structured framework for interviewing. It’s challenging to convince people to do them. When they do, they don’t always share reality.

How you phrase a question can influence the answer given. To maintain consistency, develop questions in different formats. This systematic method ensures more reliable data.

The goal of interviewing customers is to get to the core of their underlying desires and a comparison of how well your product addresses them. Ask about specifics, like product usability, customer service responsiveness, and unique features customers may be passionate about.

Interview data is qualitative, so pay close attention to recurring themes or trends that come up during conversations. Are customers consistently praising a particular feature that a competitor offers? Are there common complaints regarding a competitor’s service, such as delayed response times or lack of support?

Customer feedback can help companies adjust and improve their product development, customer service processes, and more.

Use internal data resources

Internal data shows companies where they stand compared to where they want to be—called a gap analysis.

A gap analysis can help brands validate or challenge competitor strategies. Companies may also find that they’re overlooking several potential customer segments that would help them capture greater market share.

We recommend comparing your brand’s characteristics versus those of competitors among shared audiences. You may find that a competitor outmatches your brand in a specific area. Instead of trying to win a losing battle, you can focus on a strength that exploits a competitor’s weakness, giving your brand a chance to win more market share.

Here’s an example: Imagine two major athletic footwear companies, Brand A, and Brand B. Both are targeting young, fashion-conscious consumers. Brand A’s internal data analysis reveals that, while customers recognize their quality, they perceive Brand B as more stylish and trendy.

Instead of going head-to-head with Brand B on style, Brand A could leverage its existing strength in performance technology. They might focus on marketing campaigns that highlight innovative features, like superior cushioning or breathability, emphasizing the benefits for active lifestyles. This strategy allows Brand A to create differentiation and appeal to a smaller group of the shared audience who care about performance and comfort.

Internal data keeps you grounded in reality as you perform competitive analysis. Though it’s important to stay up to date on trends and competitor strategies, chasing or copying them strategies can backfire.

Benefits for premium brands

The success of a premium brand relies on its ability to develop a perception of high quality. To do that, they must know how their customers define quality. A competitive landscape analysis can help them establish this context. As a result, they can develop products and marketing strategies that help them maintain an air of exclusivity.

For example, competitor pricing analysis enables companies to strike the perfect balance—expensive enough to feel exclusive while keeping prices competitive. As a result, they can cater to the unique desires of high-value customers who want specialized products and services.

While exclusivity plays a role in a premium brand strategy, the premium customer is at its core. Competitor analysis opens the door to the world of affluent consumers, revealing their motivations, desires, and spending habits. Brands can leverage these insights to create laser-focused marketing campaigns that speak to the hearts (and wallets) of these discerning individuals.

Competitive analysis: Sharpen your strategy, strengthen your brand

Competitive landscape analysis empowers you to understand your place in the market and use that knowledge to your advantage. You can find new opportunities, anticipate threats, and develop strategies to stay ahead of the curve.

Are you ready to gain a competitive edge? Contact The Brand Auditors today. Our expert team can help you conduct a comprehensive competitive analysis, providing actionable insights to drive your business forward.

Frequently Asked Questions

Ready to learn more?

Connect with a strategist for a no-obligation session designed to pinpoint your brand's biggest opportunities and get a clear path to successful outcomes.

POST AUTHOR

Core services

Digital marketing

audit services

Discover how to improve marketing campaigns, strengthen the impact of every customer touchpoint, and focus resources on the actions that generate more revenue.

Customer experience strategy consulting

Turn raw customer data into audience personas and laser-focused messaging.